Following the recent Conservative Conference the Help-to-Buy scheme has been brought forward from January to immediate effect.

Following the recent Conservative Conference the Help-to-Buy scheme has been brought forward from January to immediate effect.

The principle idea is that it would help first-time buyers (especially those who are not fortunate enough to have the bank of Mum & Dad) to get onto the housing ladder. A recent statistic suggested that 94% of renters would prefer to buy and this scheme is designed to help them………. or will it cause a housing bubble?

There are many questions and this editorial, I hope, will answer many of these for you and if not then you are welcome to throw some more questions at me, contact details at the bottom!

‘Why is this needed?’

Back in 2007/2008 the majority of people could go to their mortgage broker with a 5% deposit or less and get a mortgage, even those with questionable credit history. Many people took advantage of 125% borrowing which caused immediate negative equity.

Since the credit crunch of 2008 banks were exposed with bad lending books and this caused massive gaps in the lenders balance sheets. This meant that the lenders who were still willing to lend could not take on any risk so overnight the 100% and low deposit mortgages were gone and you needed a 25% deposit to get onto the housing ladder (with the better rates needing a 40% deposit). With an average house price in Greater London being £475,940 (source: BBC News 16th Sept 13), this meant you needed £118,985 deposit to get onto the ladder. Needless to say the first-time buyer market dried up hence the need for this scheme.

‘How does this work as surely the banks have the same risk’?

Actually no, the bank’s exposure is less as the government reduce this risk by ultimately acting as guarantors for a portion of the mortgage. Therefore the banks can offer 95% loans again and if the borrower defaults on the mortgage, the government guarantee’s the extra 15% so the banks ultimate risk is 80% which means their lending book remains strong and hopefully this will be reflected in the rates offered.

‘So can I buy immediately?’

Not exactly. You can source your property and source your lender (we have a mortgage arm by the way) but you are not able to complete until the new year albeit you can exchange contracts beforehand it is believed. In reality, even if you found a property today you would have to rush things through to beat this timeline anyhow!

‘I couldn’t get a mortgage before because I had some credit issues, will this scheme help me?’

Sadly you will be in the same position as before. The lender still has to undertake a due diligence process and if you have had past problems then you are likely to still have a challenge on your hands to get a mortgage. However if your credit issues were historic and you have had clean credit for a long period then it is worth seeing an Independent Mortgage Adviser to assess your options (again, such as our mortgage broker arm).

‘I am led to believe I can only buy a new build property, is this true?’

Nope this was the case until now. You can buy an older property or newly built if you wish. Please note that the lenders criteria for property types still stands so take advice especially before you purchase an ex-council, high rise property, decked access, past subsidence property etc.

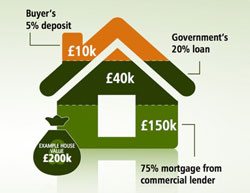

‘I was informed that I would get a 20% loan from the government towards my purchase?’

‘I was informed that I would get a 20% loan from the government towards my purchase?’

This is the scheme for new builds only whereby the government scheme loans you 20% deposit then you can add a further amount to get the benefit of cheaper interest rates at 75%. The new scheme for non-new builds is a guarantee scheme rather than a physical loan!

‘I am not a first-time buyer, can I still take advantage of the scheme?’

Yes you can as it is also designed for those who cannot move due to a lack of equity in their property. However, you could have an abundance of equity and still wish to take part in the scheme but this is highly unlikely as it would not make financial sense for those in this position.

‘What is the maximum amount I can purchase for?’

£600,000

‘Can I buy a second property if I am going to live in it (i.e. rent out my existing residence)?’

No, certainly not. You must only own one property to take advantage of this scheme.

‘What lenders are signed up to the scheme?’

At the time of me writing this (01st October) it is only the banks where UK Plc have ownership who are participating (RBS group which Incorporates NatWest and Lloyds being their Halifax brand). I am reliably informed that banks such as HSBC, Santander, Nationwide and Barclays are considering (hopefully by time of print they will be fully signed up members of the scheme). I would recommend speaking to an Independent Mortgage Adviser such as Conran Financial (contact details at bottom).

‘Could this scheme inflate prices?’

I am saddened to suggest that in my opinion it will inflate prices especially in London, but I feel it will create a potential bubble which is not sustainable over the medium term unless the authorities manage the scheme in a steady and sustainable way.

‘How much will prices increase in 2013?’

‘How much will prices increase in 2013?’

Again, only my opinion, but I feel it will increase by 15% in London. Some other analysts and industry experts are suggesting that the market is purely catching up from 2007 to date but, me being the sceptical one, feels differently.

Whilst writing I wanted to mention a new deal in advance to Greenwichmums. We are gaining great success in Greenwich Borough and feel it important to put our money where our mouth is so we have a deal for anyone looking to sell…

If you instruct us and we do not sell your property in 14 days then we reduce our fee by 50%. Now there is a deal!

There are some obvious terms and conditions but we are totally up front and they are certainly not onerous rathermore transparent as you would expect from one of the leading agents in Greenwich. Please email me directly with your name and address and I will happily furnish you with full details of my new offer.

I hope this clears up any questions you may have and please feel free to contact me with any questions at md@conranestates.co.uk or if you want mortgage advice on any type of mortgage, including Help to Buy, then call 020 8294 3099 or email by clicking here.

You must be logged in to post a comment.